10 Money Management Skills You Need to Build and Keep Your Wealth

Wealth studies consistently show that a very large majority of families lose their wealth quickly…by the second and third generations.

Why, do you think, that is?

A number of reasons.

In most cases, children were not prepared to handle a large sum of money and assets, so they lost their inheritance through mismanagement.

As the children were not involved in the wealth building process, they didn’t have the skillset needed to manage their resources well.

1. Forget instant gratification

Growing wealth is a long sum game. Whether you’re buying an investment property or investing in shares it takes time to grow assets.

2. Is it a need or a want? Know the difference

Do you really need that bigger home? What about those toys? If you’re borrowing to finance a lifestyle your income can’t afford, then you’re robbing from your own future.

3. Automate your savings and investing

If you’re not having a portion of your income sent to an interest bearing savings and/or retirement account, get started now.

Just like brushing your teeth every morning and night is a habit, the concepts of investing and building wealth should be a part of your day to day life.

If it’s a part of your mindset you’ll automatically make decisions based on your desired outcome.

4. Understand the cost of debt and ownership

Rather than consider whether or not you can afford a monthly payment, figure out the entire cost of ownership before making a decision.

As always, the numbers should dictate your decisions, not your emotions.

For example, if you’re buying an investment property that is geared negatively, are the tax savings you’ll receive more beneficial to your financial situation and your goals than a neutral or positively geared property?

5. Begin with what you want, set your goals, then work backward

Make decisions based on your goals. If you haven’t clarified what you want, how will you know when you’ve achieved it?

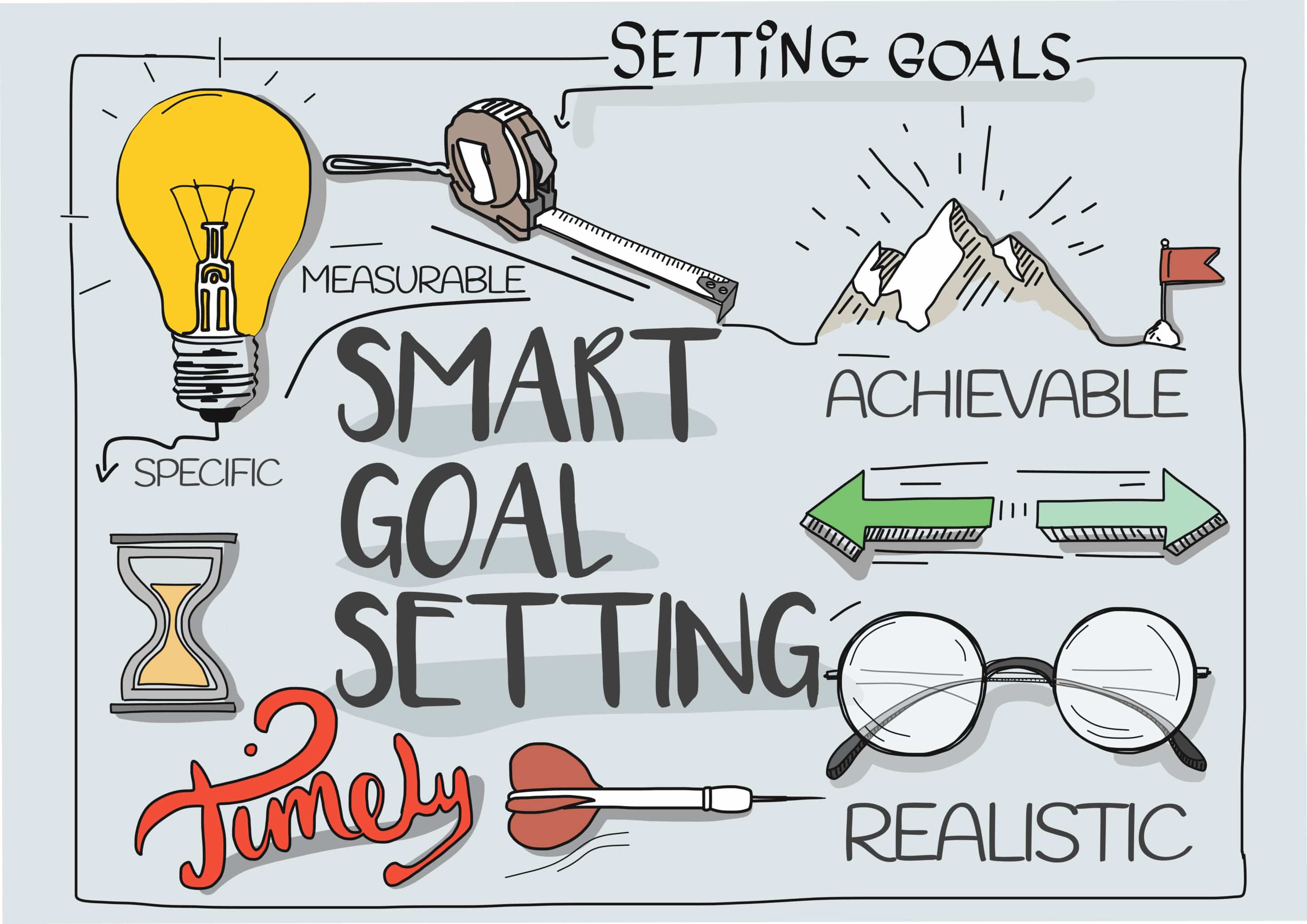

One popular goal setting strategy we use with our clients is the S.M.A.R.T. method, which is designed to help them narrow down what they want and what it will take to achieve their desires.

6. Live within your means

We can’t discuss money management without covering the most basic of skills; budgeting.

The most important plan, it is said, is the one that you follow.

Make it easy on yourself and consider your personality, where you’re at in life, and your financial capacity when setting up a spending plan.

7. Be willing to make short-term sacrifices

Every decision you make today will have an impact on your future self.

Often, life is about tradeoffs. Be willing to give up something you want now for something better in the future.

8. Ask for help

Building wealth is not a solitary endeavour. Sometimes, you just need the help of a professional.

For example, even if you’ve learned everything you can about buying a particular investment property, you’ll pick up more information from somebody who knows the area than the search engines will ever give you.

Ask for help when you need it.

9. Run the numbers

Don’t make assumptions.

Should you buy the new investment property or the older one?

Ask a seasoned property investor and they’ll tell you that it depends.

Your financial situation, your goals, the suburb’s postcode…there are any number of factors to consider when managing your money and building your wealth and each of them will impact your decisions.

10. Take advantage of opportunities

Pay-g variations, negative gearing, renting out your principal residence…there are any number of tools you can use to grow your wealth.

When you’ve set up a plan of automatically saving and investing, you’ll open yourself up to opportunities to build your wealth that you might otherwise miss out on.

If you’re after more tips related to Property Investment, you should join us at our next Property Investor Night and meet with our wonderful Coaches. You’ll be able to ask them any question you want and it’s a free event! Book your seat here.

Successful Property Investors Don’t Quit Their Day Job

You need that income! One of the primary things you need to be a successful property investor is a job. Why? Because you need money. You need a job to borrow money. You need savings or some cash to buy your first property. But the sad fact is, a lot of people...

6 Ways To Speed-Up Your Next Property Purchase

Get There Faster If you are already a property investor with one or even two properties, first of all, congratulations. You’ve taken some seriously great steps in creating your future wealth and a pathway to a work-less, play-more retirement with passive...

Property investing: Five ways to create cashflow boom!

When it comes to property investment there are some things you can never have enough of.

When it comes to property investment there are some things you can never have enough of. Good tenants, reliable builders, a great relationship with your bank.

But more than anything what you need is good cash flow.

Having a steady income of cash means never having to dip into your own pocket to top up repayments, complete repairs or make another purchase.

Here are the top five ways you can ensure the cash keeps flowing, so you can keep your investment portfolio growing.

Lock it in! How to protect your equity

Don’t be caught without it.

As a property investor who is building a portfolio, it’s vital that you have access to your equity whenever you need it.

There’s nothing more frustrating than finding that perfect new property to purchase, only for it to be held up – or worse still, lost completely – because your finances weren’t in good shape.

Having an interest-only loan structure with a healthy off-set account is a great way to ensure you have equity at your fingertips whenever you need it, but that’s not the only way…