$87K Made In 12 Weeks Through Renovation! What’s Stopping You Making Money?

How Positive Real Estate Clients Made $87K in 12 weeks through a strategic renovation

Do you know everyday Aussies are making huge profits RIGHT NOW! If you wish to find out exactly how they are doing it then today’s video is a MUST-SEE!

It is amazing how economic and financial experts and the media can easily influence your financial decisions so readily, which can cause analysis paralysis and prohibit you from actually making money through property investing. The media is often wrought with unjustified claims and scare-tactics designed to drive traffic to websites and newspaper sales.

It is all just a load of ‘Chicken Little.. The Sky is Falling’ housing bubble baloney!

One of the key differences between making a little and a LOT of money is who you let influence your investing decisions! The real truth is that no matter what the market is doing, there is always money to be made – if you do your due diligence and take the time to get educated!

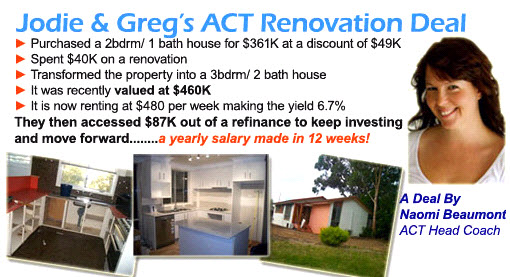

For instance, this week we show you a detailed example of a renovation clients Jodie and Greg Bush completed under the guidance of their Head Coach where they made $87K in only 12 weeks, in the ACT in a flat market; simply by ignoring the negative sentiment around them and by seeking the RIGHT advice. This exciting story was covered back in the May 2012 issue of API Magazine.

Now we didn’t classify the ACT as one of our chosen HOTSPOTS for 2012 (as Canberra reached a market high in 2009); however in saying that it is a very constant and quite a safe market. The Government controls supply and demand well and the household income is very high, making it a secure area to invest in with an-average capital growth rate of approximately 9% per year. We often refer to the Canberra market as your “retirement fund”.

Check out the numbers:

| THE NUMBERS | |

| Purchase Price | $361,000 |

| Renovation costs | |

| Kitchen | $6,990 |

| Carpentry | $9,130 |

| Plumbing | $9,100 |

| Electrical | $5,000 |

| Rubbish removal | $2,000 |

| Excavator | $2,200 |

| Tiles | $1,000 |

| Shower screens, mirrored robes | $1,800 |

| Painting | $800 |

| Toilets and vanities | $650 |

| Sundries | $1000 |

| Total renovation costs | $39,670 |

| Post-renovation vanuation | $486,000 |

| Approximate equity gain (not allowing for buying costs) | $85,000 |

In today’s video, previous Head Coach of the ACT Naomi Beaumont, discusses two of her clients Jodie and Greg Bush in detail – the steps she helped them take with their renovation including negotiations with the agent and finance structure which the very prestigious API Magazine covered – as the story is a HUGE renovation success.

Jodie and Greg are holding onto this property and as the land size is so large at 943sqm, they are looking add further value with a house or granny flat in the future.

Click here to like us on Facebook and see more updates like this.

Hey there, do you enjoy the Positive Real Estate Blog? If you did, why don’t you book into a Property Information Night in your area and get more information from our team. You can do so here.

Also, if you can not wait, click here to access the Property Mini Course and signup for our email newsletter. This FREE 2 hours video series gives you some of the top tips from our team that you can use right now. Thanks.

Take the Next Step

Investment Property Financing – Comprehensive Guide 2023

You won’t get very far as an investor without...

Ultimate Property Investment Strategy Guide 2023

Which Property Investment Strategies Will Make...

How to Build a Property Portfolio with $100k or Less

Starting your property investment journey can...